Since stock market prices fluctuate on phases of supply and demand investors can trade securities to capitalize on these market price movements. Informed investment decisions based on precise price movements depend on understanding the concepts of accumulation and distribution. These phases of market behavior can help investors identify potential trends and make strategic moves to make a profit. In this article, we will identify what accumulation and distribution, explore their significance, and suggest strategies for using them to individual investor advantage.

Identifying Accumulation

Accumulation refers to a phase in the market cycle when institutional investors, such as mutual funds, pension funds, and hedge funds, begin accumulating stocks or other securities. During this phase, informed market participants believe that the prices of certain stocks are undervalued or have the potential for future growth.

Accumulation can occur after a prolonged downtrend, when investors see an opportunity for a potential reversal. Institutions and savvy investors accumulate stocks during this phase, gradually increasing their holdings. Their actions create demand, leading to a steady rise in prices.

Key Indicators of Accumulation

Volume - Increasing trading volume is often a strong indicator of accumulation. Higher volume suggests increased market participation, signaling institutional buying.

Price Stability - During accumulation, prices tend to stabilize or form a base, indicating that buyers are supporting the stock at a certain level. This consolidation phase often precedes a potential upward move.

Positive News Flow - Accumulation is often accompanied by positive news or events that suggest the stock's potential growth. These catalysts can attract institutional interest and encourage buying activity.

Strategies for Accumulation

Identify Fundamental Value - Conduct thorough fundamental analysis to identify undervalued stocks with strong growth potential. Look for companies with solid financials, a competitive advantage, and a positive outlook for the industry.

Technical Analysis - Utilize technical indicators and chart patterns to identify accumulation phases. Look for consolidating price patterns, increasing volume, and signs of buying pressure.

Patience and Gradual Buying - Accumulation is a patient strategy. Gradually build your position over time, taking advantage of price dips and consolidation periods. This approach minimizes the impact of short-term market fluctuations.

Identifying Distribution

Distribution is the opposite of accumulation and occurs when institutional investors begin to sell their holdings. It typically happens after a prolonged uptrend, when investors believe that a stock is overvalued or when they anticipate a market decline.

During distribution, institutions and informed investors gradually sell their positions, creating selling pressure and reducing demand. This can lead to a decline in stock prices.

Key Indicators of Distribution

Volume - Increasing trading volume during a downtrend suggests distribution. Higher volume indicates a surge in selling pressure and signals that institutions are offloading their holdings.

Price Weakness - Stocks experiencing distribution tend to exhibit weak price action, with lower highs and lower lows. This indicates a loss of buying interest and the potential for a downward trend.

Negative News Flow - Negative news, disappointing earnings reports, or adverse events can trigger distribution. Institutions may use such catalysts as opportunities to sell their positions.

Strategies for Distribution

Set Price Targets - Establish realistic price targets for your investments based on fundamental and technical analysis. Consider selling when the stock reaches your target or shows signs of weakness.

Trailing Stops - Utilize trailing stop orders to protect profits during distribution phases. These orders automatically adjust the sell price based on the stock's performance, allowing you to capture gains while limiting potential losses.

Diversify Your Portfolio: Spread your investments across different sectors and asset classes. Diversification helps mitigate the impact of a single stock's distribution on your overall portfolio performance.

Bottom Line

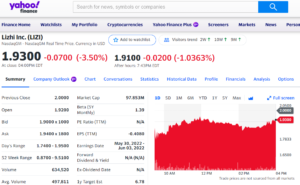

Accumulation and distribution are integral phases of the stock market cycle that can provide valuable insights into the actions of big smart money stock investors and potentially help individual traders move in conjunction with the smart money that is moving the market. Quick identification of stocks being accumulated or distributed is key to maximizing profits. Most Excellent investor members have access to watchlists made up of stocks in both phases aggregated so that quick decision making can occur for buying or selling. Sign up now.